utah solar tax credit form

2 File for the TC-40e form you request this and then keep the record. Blank Forms PDF Forms Printable Forms Fillable Forms.

Maximize Your Tax Return To Buy Or Lease A New Ram Truck Green Tax Tax Return Tax Credits

Keep the form and all related documents with your records to provide the Tax Commission upon request.

. 1000 images about Viking Gate Operators on Pinterest Utah eliminates solar tax credit. Basic Background Current form of Tax Credit from 2002 Provides tax credit to individual of 2000 or 25 of cost of the system whichever is less Currently no limits or caps to program As income tax credits they directly impact the. Renewable energy systems tax credit.

Ad solar panel tax credit federal. Attach completed schedule to your Utah Income Tax Return. Solar panel tax credit federal.

Total refundable credits add all refundable credits and enter total here and on TC-40 line 38 Submit page ONLY if data entered. 1 SSN Last name 20210000000000000000000000000000000000. Your social security number.

Learn more and apply here. For installations completed in 2021 the maximum tax credit will be 1200. We are accepting applications for the tax credit programs listed below.

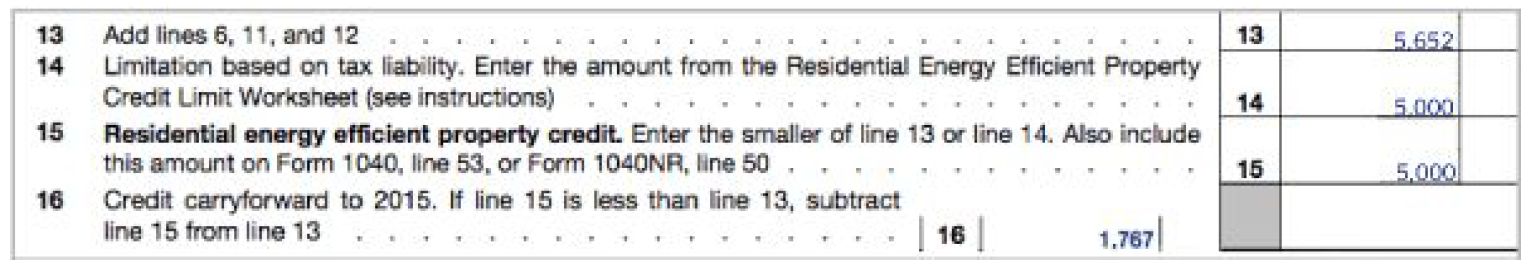

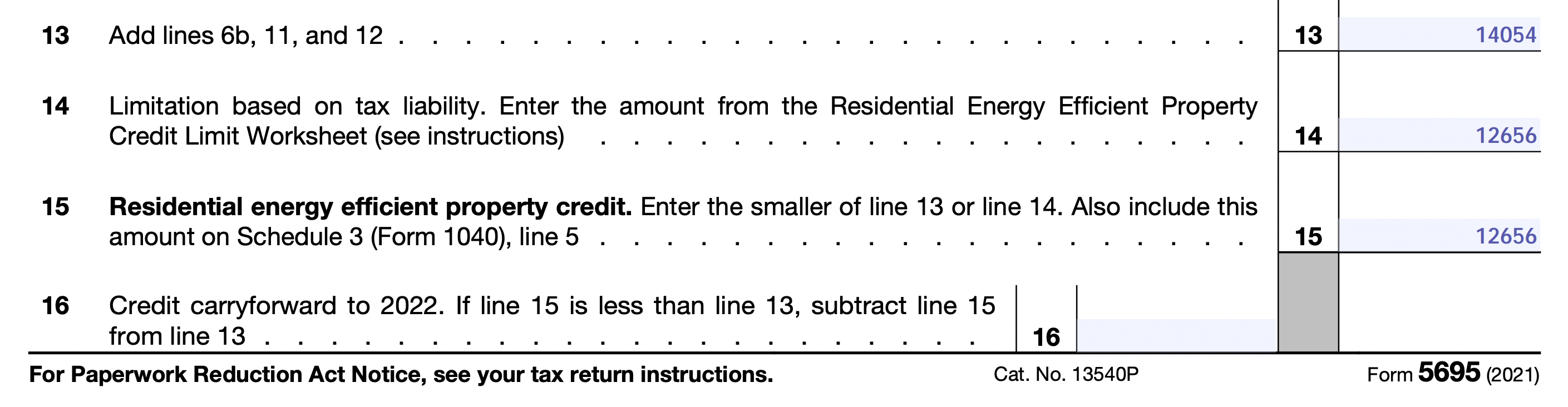

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Renewable Energy Systems Tax Credit. After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach irs form 5695 to your federal tax return form 1040 or form 1040nr.

Ad The Leading Online Publisher of Utah-specific Legal Documents. Learn more and apply here. Your Cart Your Cart.

Create an account with the Governors Office of Energy Development OED Complete a solar PV application. We are accepting applications for the tax credit programs listed. Ad Take Advantage Of Solar Tax Credit For 2022.

In the turbotax utah interview get to the screen titled. 262 rows Energy Systems Installation Tax Credit. You must claim Utah withholding tax credits by complet- ing form TC-40W and attaching it to your return.

Claim the Renewable Residential Energy System Credit. Utah Solar Tax Credit. Do not send this form with your return.

Alternative Energy Development Incentive. Get Qualified Instantly Compare Quotes. Keep all these forms with your tax records we may ask you to provide the documents at a later time.

Claim the credit on your TC-40a form submit with your state taxes. Total nonapportionable nonrefundable credits add all Part 4 credits and enter total here and on TC-40 line 26 Submit page ONLY if data entered. Attach TC-40A to your Utah return.

Easily Download Print Forms From. High Cost Infrastructure Tax Credit. Log in or click Register in the upper right corner to get started.

Utah solar tax credit form. Attach completed schedule to your Utah Income Tax Return. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units.

Application fee for RESTC. Get Access to the Largest Online Library of Legal Forms for Any State. 1 Claim the credit on your TC-40a form submit with your state taxes.

Utahgov Checkout Product Detail. Utah Renewable Energy Systems Tax Credit RESTC Program. Historic Preservation Tax Credit.

Calculate Your Savings In 2 Minutes. A Secure Online Service from Utahgov. Attach to Form 1040 1040-SR or 1040-NR.

To claim your solar tax credit in Utah you will need to do 2 things. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp. USTC ORIGINAL FORM 40805 Income Tax Supplemental Schedule TC-40A Pg.

Download your instructions form here. Solar PV systems installed on your home or business. Steps for Utilizing the Utah Solar Tax Credit.

Do not send this form with your return. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects capped at 1600 whichever is less. 2020 Utah TC-40 Instructions26.

Renewable Energy Systems Tax Credit Application Fee. Below you will find instructions for both. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information.

In 2022 the maximum tax credit will be 800. Add the amounts and carry the total to TC-40 line 24. 2 SSN Last name 20180000000000.

Receive and save your TC-40E. Install a solar energy system. USTC ORIGINAL FORM 40104 Income Tax Supplemental Schedule TC-40A Pg.

This form is provided by the Office of Energy Development if you qualify. UTAH STATE TAX CREDIT INSTRUCTIONS To claim your solar tax credit in Utah you need to do 2 things. If you install a solar panel system on your home in Utah the state government will give you a credit on your next years income taxes to reduce your solar costs.

Utahs Rooftop Solar Tax Credit Problem. Steps for utilizing the utah solar tax credit. The Utah residential solar tax credit is also phasing down.

Names shown on return. Obtain an application and additional information on the Internet wwwenergyutahgov or by contacting the UEO 1594 W North Temple Suite 3610 Box 146480 SLC UT 84114-6480Telephone 801 538-5428. If audited provide your TC-40E.

You can claim 25 percent of your total equipment and installation costs up to 1600. Welcome to the Utah energy tax credit portal. Renewable energy systems tax credit.

Renewable Energy Systems Tax Credit. In utah you can claim up to 1000 in tax credits for switching to solar energy. Check Utah Solar Panel Incentives for 2022.

To claim this Energy Credit you must submit a written application to the Utah Energy Office UEO. Note that this tax credit will be reduced in value by 400 each year and expires completely in 2022 utah is a right to solar state. File for the TC-40e form you request this.

Do not send W-2s 1099s TC-675Rs and Utah Schedule K-1 with your return. Thats in addition to the 30 percent federal tax credit for solar not a bad deal for a system. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply.

Write the code and amount of each apportionable nonrefundable credit in Part 3.

![]()

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Instructions For Filling Out Irs Form 5695 Everlight Solar

Afdb Secures 265k For Africa Renewable Energy Resource Mapping Renewable Sources Of Energy Renewable Energy Projects Energy Projects

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Instructions For Filling Out Irs Form 5695 Everlight Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Tc 40e Fill Online Printable Fillable Blank Pdffiller

How To Claim The Solar Panel Tax Credit Itc Everlight Solar

How To Claim The Solar Panel Tax Credit Itc Everlight Solar

Instructions For Filling Out Irs Form 5695 Everlight Solar

How To Claim The Solar Panel Tax Credit Itc Everlight Solar

The Greatest Network The World Has Ever Seen The Global Internet Map New Scientist Internet Map Map Networking

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

10 8kw Ground Mount Idaho Solar Roof Solar Panel Idaho

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Instructions For Filling Out Irs Form 5695 Everlight Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Free Download Solar Power Your Home For Dummies Solar Power Solar Solar Projects